Online Banking

Sign Up!

Learn the pros, cons and costs of an extended mortgage.

As conversations around 50-year mortgages gain traction nationwide, you may be wondering what those extended terms could really mean for homeowners. While an ultra-long home loan might seem attractive – especially to first-time homebuyers – the long-term costs might not be worth it.

Here’s a closer look at how extended mortgages typically work, along with the pros, cons and costs.

Key Takeaways

A longer-term mortgage might seem like a good option if you need lower monthly payments to make homeownership more affordable, improve cash flow flexibility or qualify for a loan more easily. But the total interest a homeowner pays over the life of a loan is significantly higher with a 50- or 40-year mortgage.

In fact, that’s why Gate City Bank only offers up to 30-year mortgages – focusing on terms that help our customers build equity faster, provide flexibility and avoid excessive interest costs over time.

For example, the monthly principal and interest payment on a $400,000 home (excluding down payment, property taxes, and insurance) at 6% interest would be:

By comparison, using the same price and interest rate, the total interest paid over the life of the loan would be:

If permitted by your bank, extending your mortgage term up to 50 years might lower your monthly payment by $292.58, assuming interest rates remain the same for the longer-term home loans. But by saving $14,629 in monthly payments, you’d be significantly increasing your total cost by adding nearly $400,000 more in interest over the life of your loan.

Use our mortgage comparison calculator to compare loan amounts, loan terms, interest rates and more to see which options might work best for you.

Find outIf interest over the life of your mortgage doesn’t matter as much to you because you plan to sell or refinance after a few years, you’ll want to consider your home equity. This is the difference between what your home is worth and how much you owe on your mortgage.

Home equity can be a valuable financial tool to help you access lower-interest loans and credit.

Here's howWhile you still build equity with an extended mortgage, it happens much more slowly than with a 15- or 30-year mortgage. This is because of the way the amortization schedule works – early payments primarily go toward interest rather than your principal. When you extend the term an extra 10 or 20 years, you’re mainly paying interest and not building much equity for the first several years. If you decide to sell your home during that time, you’ll get very little cash back despite everything you’ve paid.

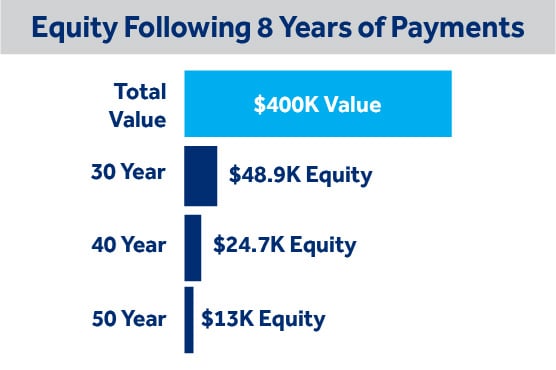

Here's a look at the difference in equity if you sell your home after eight years:

Wondering about other ways to save on your first home or reduce your monthly payment? As North Dakota’s top mortgage lender, Gate City Bank offers several flexible and unique mortgage options, including:

First-time homebuyer credit

As a first-time homebuyer, receive a $250 credit from Gate City Bank toward your closing costs.1

BetterLife™ Student Loan

This unique program helps mortgage customers consolidate debt and pay off student loans faster with no fees and a low interest rate.

Professional loan program

If you’re relocating to North Dakota or Minnesota – or if you’ve recently graduated with an advanced degree – this program offers low down-payment options for local professionals.

VA loans and special offers

These loan options for veterans, military members and their spouses come with low-to-no down payment, lower monthly payments and easier qualifications compared to conventional financing.

Rural Development Loan

These loans are specifically for low-to-moderate income families in rural North Dakota and Minnesota and can help make homeownership more affordable.

New home construction rate lock

Building a home? Protect your interest rate with 12-, 15- or 18-month rate lock.

Rate confidence

Need some flexibility? Gate City Bank lets you relock your interest rate once during your rate lock period – for free – if rates go down. For customers who need more time to close, we also offer an extended lock that protects your rate as long as you have a contract in place.

Want to learn more, including finding out about today’s rates? Your first step is to schedule an appointment with a mortgage lender to ask questions, discuss different options and get a free pre-approval. And if you aren’t quite sure how much home you can afford, don’t worry – we’re here to help!

From competitive interest rates to local service down the street, discover why we’re the #1 mortgage lender in North Dakota.

First home. Second home. Forever home. Whatever your next move, we’re right beside you with competitive rates, local service and free pre-approvals.

Make yourself at home! Kick back and explore expert advice on a range of insightful homeownership topics.

1 This $250 credit only applies to first-time homebuyers purchasing a primary residence within 100 miles of a Gate City Bank location. Customers must have a Gate City Bank checking account. Other terms, conditions and qualifications may apply. The credit will show up on the mortgage loan at closing.