Online Banking

Sign Up!The standard Federal Deposit Insurance Corporation (FDIC) limit is $250,000 per depositor, per bank. To calculate your own deposit insurance coverage, please visit the FDIC’s deposit insurance estimator.

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the U.S. government that protects bank customers against the loss of their insured deposits in the event that an FDIC-insured bank or savings association fails. FDIC insurance is backed by the full faith and credit of the U.S. government.

Customers of FDIC-insured banks, including Gate City Bank, are covered by the FDIC for up to $250,000 per depositor, per bank.

Deposit insurance through the Federal Deposit Insurance Corporation (FDIC) protects bank customers in the event an FDIC-insured financial institution fails. It’s available for any deposit account opened at an FDIC-insured bank; there’s no need to purchase it!

Deposit insurance is calculated dollar-for-dollar up to FDIC limits – factoring in the principal amount plus any interest accrued or due to the depositor – through the date of default. The FDIC has created an insurance estimator that you can utilize for more information on how this may personally impact you.

Yes. We’re proud of our longtime relationship with the Federal Deposit Insurance Corporation (FDIC), which goes back since 1935!

Learn more about the FDIC and our commitment to keeping your money safe and secure.

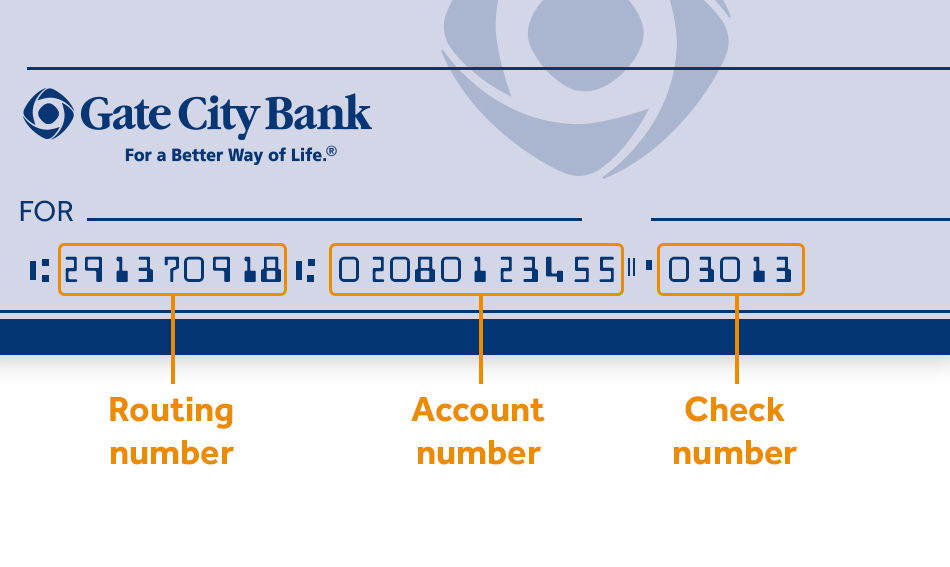

Your account information is located specifically at the bottom of your check. Beginning from left to right, you’ll see your:

Subtract the current mortgage balance(s) from the present market value to estimate the equity (net value) you have in your home. You can also try out our helpful home equity calculator!